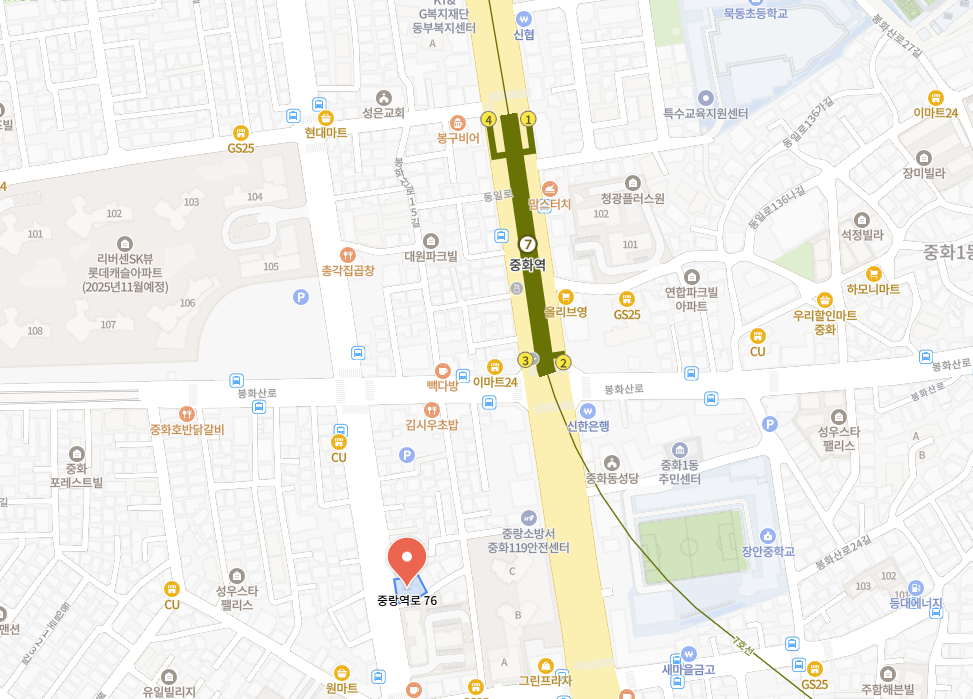

Tax refund for

foriegner worker

최대5년간 세금

최대5년간 세금 최대100% 환급

최대100% 환급 평균243만 환급

평균243만 환급

TAX KOREA is a company that specializes in tax-related work for Filipinos working in Korea. Filipino consultants diagnose customers' taxes accurately and quickly with a professional tax diagnostic system.